The retail banking sector is experiencing a major transformation as KBC and Ulster Bank prepare to exit the Irish market and the retail banks repurpose many of their branches nationally.

A new programme that will upskill bank professionals with in-demand skills at this crucial time for the retail banking sector has been launched by IFS Skillnet, Financial Services Ireland, IOB (the Institute of Banking) and the five main retail banks – AIB, Bank of Ireland, Permanent TSB, KBC and Ulster Bank.

The Skills Ignite for Financial Services programme will support individuals to develop in-demand skills to progress in their current employment as well as improving employability for those leaving jobs, by providing a selection of training courses to ensure Ireland remains competitive, with a skilled workforce that can attract and retain global corporations.

Skillnet Ireland Chief Executive Paul Healy said: “The financial services sector is undergoing significant transformation and the introduction of this programme will help banks and their teams to prepare and adapt. By collaborating closely with firms, we are helping the sector to identify the skills of the future, to embrace new technologies and to respond to the ever-evolving needs of customers.”

Widening the financial services skills base

The Skills Ignite for Financial Services initiative was designed in partnership with enterprise to enhance cross-sector employability and reskilling for financial services employees who will be impacted by the exit of two retail banks and redundancies in the sector.

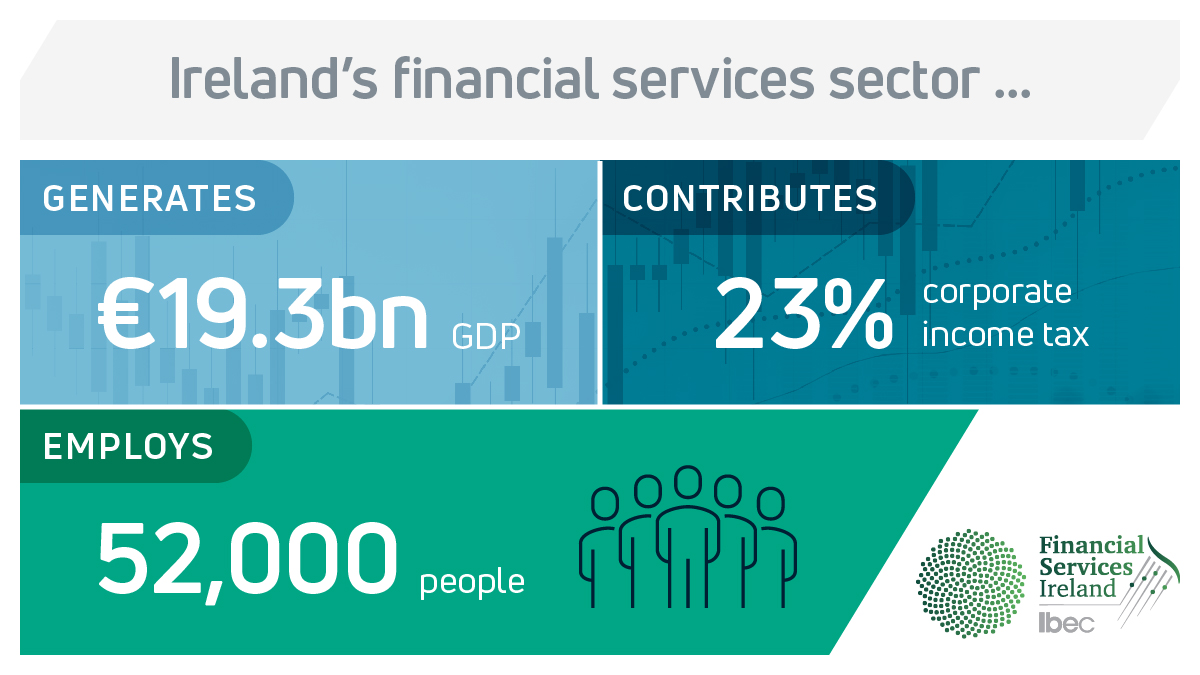

Speaking at the launch, Patricia Callan, Director of Financial Services Ireland (FSI) – the Ibec group that represents the sector – said: “Widening Ireland’s financial services skills base is a key pillar of the recently published Financial Services in Ireland – Skills of the Future report. The Skills Ignite programme will support individuals to identify and validate existing skills and compare them to the market opportunities they see.

Callan added: “It will also offer a range of microlearning, skills certificates and qualifications to enable individuals to learn about different career options and gain the necessary skills to prepare them for new roles. In particular, the programme supports continuous professional development via events, thought leadership and other professional development activities to ensure individuals’ skills remain current.”

IOB Chief Executive Mary O’Dea said: “Skills Ignite enables financial services employees to assess their skillset, identify career and learning opportunities and, crucially, to gain new skills to meet the future and ever-changing needs of the broader financial sector. The skills required to thrive in financial services are changing. Significant stakeholder engagement has been used to identify the in-demand skills and provide targeted learning to support professionals in upskilling quickly and effectively.”

Learn more

Learn more about the Skills Ignite programme at https://www.ifsskillnet.ie/news/skills-ignite-for-financial-services-programme/.

Stay connected with Skillnet Ireland

Receive regular news and insights from the world of talent development straight to your inbox.

By adding my email, I agree to the use of my personal data in accordance with Skillnet Ireland's Privacy Policy.